Picture this: you’re weaving through a sea of scarves and chants outside Allianz Stadium, Juventus fans roaring in anticipation. No fumbling for cash or cards at the concession stand. Instead, a quick tap with your phone unleashes soccer fan tokens stadium payments, settling up for a birra and a scarf using your $JUV balance. This seamless blend of fandom and finance isn’t a distant dream; it’s the 2025 reality powered by Chiliz, where Fan Tokens on Socios. com are rewriting matchday rituals. With CHZ trading at $0.0315 after a modest 24-hour gain of and $0.000640 ( and 2.07%), the ecosystem shows steady momentum amid broader crypto volatility.

Chiliz has methodically positioned Fan Tokens as practical utilities, far beyond speculative trades. Clubs like Paris Saint-Germain and Juventus aren’t just issuing digital badges; they’re embedding tokens into the physical pulse of game day. Fans holding $PSG or $JUV now unlock tangible perks, from priority ticketing to exclusive drops, fostering loyalty that translates to real revenue for teams. As a portfolio manager eyeing emerging assets, I see this as a smart diversification play: low entry barriers, high engagement upside, and hedges against traditional sports memorabilia depreciation.

Cashless Payments Streamlining the Stadium Flow

At the forefront of this shift stands Chiliz’s partnership with Alchemy Pay, rolling out fiat-crypto gateways that make Socios fan tokens cashless transactions a breeze. Fans top up via bank cards or local payment rails, then spend Fan Tokens on tickets, jerseys, and grub without ever leaving the app. Security is baked in through blockchain verification, slashing fraud risks that plague legacy systems. During the 2024-2025 season trials, venues reported faster queues and happier crowds, proving the model scales from Camp Nou to Parc des Princes.

This isn’t hype; it’s measured evolution. Teams fund stadium upgrades directly from token sales, pulling in global supporters who might never set foot on site.

Take Juventus: their Fan Token holders snag VIP access perks, now layered with frictionless spending. It’s a win-win, balancing fan empowerment with club coffers. Yet, strategically, investors should watch adoption metrics closely; with CHZ at $0.0315, sustained volume from these integrations could signal breakout potential without overhyping short-term pumps.

AR Features Elevating Fan Immersion

Chiliz doesn’t stop at payments; it’s layering on Chiliz fan tokens AR features that turn passive spectators into active participants. Through Socios. com, clubs like Sevilla FC, Atlético de Madrid, and Valencia CF dropped commemorative NFTs redeemable via AR. Point your phone at the pitch, and digital overlays burst to life: player stats hovering mid-air, virtual high-fives from idols, or interactive challenges yielding exclusive rewards. These aren’t gimmicks; they’re sticky experiences boosting token utility and retention.

Paris Saint-Germain led the charge, celebrating five years of $PSG with AR-enhanced collectibles that fans mint and flaunt. Imagine scanning your seat for a personalized AR message from Mbappé’s successor, or joining global AR hunts synced to match events. This tech bridges digital divides, drawing in younger demographics while giving veterans fresh ways to connect. From an investment lens, it’s balanced gold: AR drives token velocity, supporting price floors amid market dips.

Chiliz (CHZ) Price Prediction 2026-2031

Conservative and balanced outlook based on fan token adoption, cashless payments growth, AR features, and broader crypto market trends

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2026 | $0.040 | $0.065 | $0.095 | +106% |

| 2027 | $0.050 | $0.095 | $0.140 | +46% |

| 2028 | $0.065 | $0.140 | $0.205 | +47% |

| 2029 | $0.085 | $0.205 | $0.300 | +46% |

| 2030 | $0.110 | $0.300 | $0.430 | +46% |

| 2031 | $0.140 | $0.430 | $0.75 | +43% |

Price Prediction Summary

Chiliz (CHZ) is expected to experience progressive growth from its current $0.0315 price, driven by enhanced fan engagement through Socios.com innovations. Minimum prices reflect bearish market cycles and competition, while maximums account for bullish adoption surges, potentially reaching $0.75 by 2031 in optimistic scenarios with regulatory tailwinds and sports partnerships.

Key Factors Affecting Chiliz Price

- Accelerated fan token adoption in soccer clubs like Juventus, PSG, and others via Socios.com

- Cashless payments integration with Alchemy Pay for tickets and merchandise

- AR features and commemorative NFTs boosting immersive matchday experiences

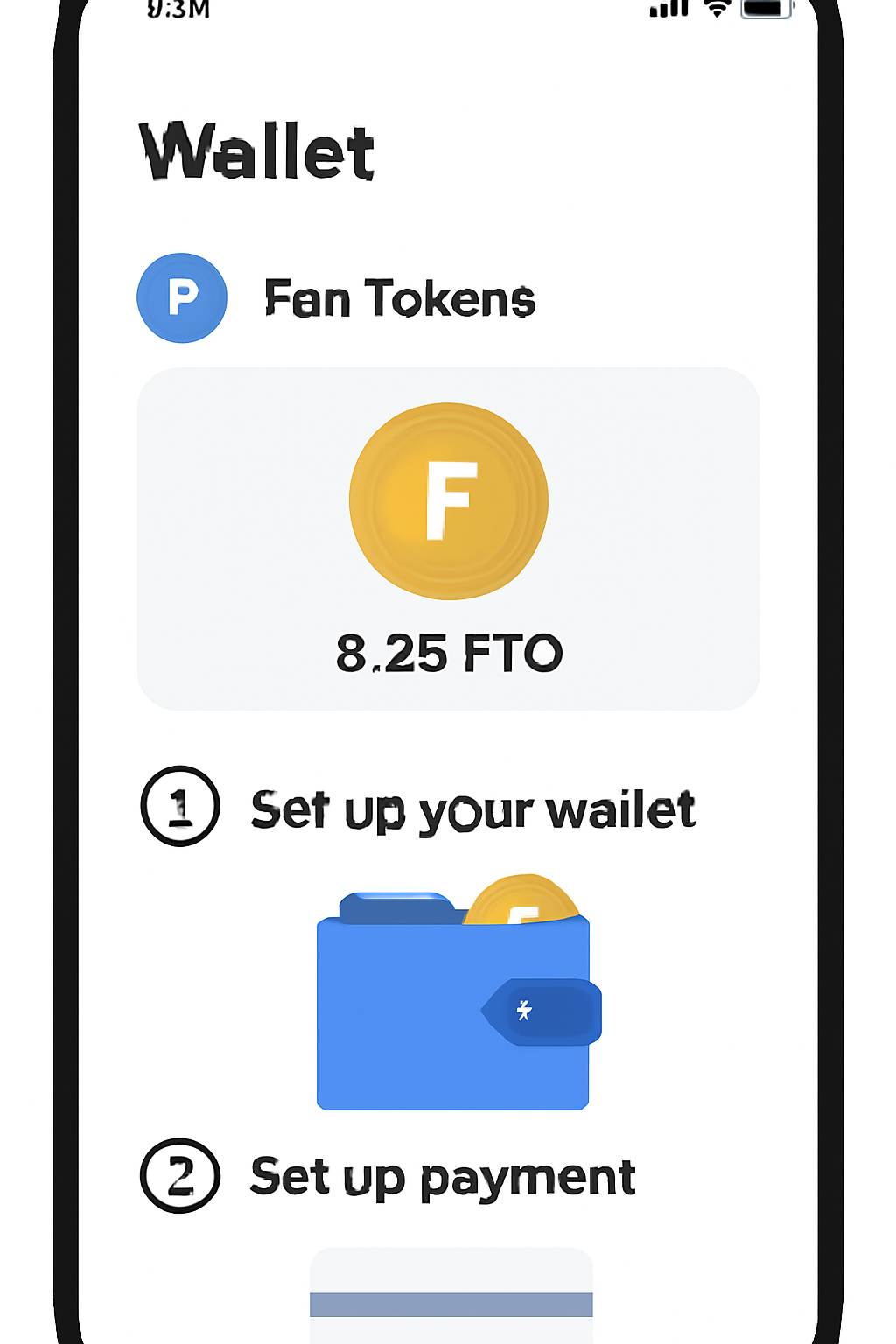

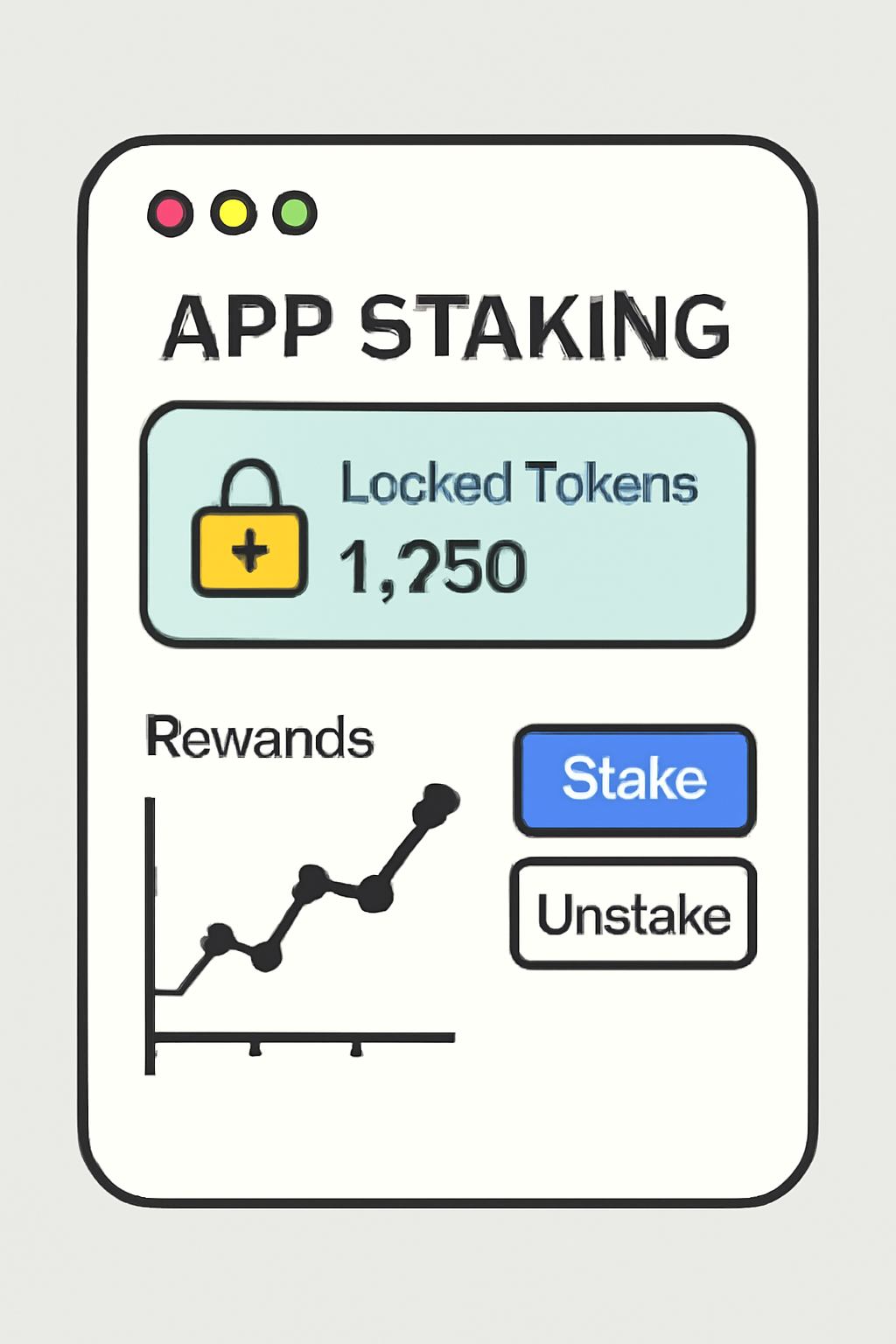

- Fan Token staking rewards on Socios.com Wallet for holder loyalty

- Ecosystem expansion with Naver Pay and U.S. market entry amid Web3 sports growth

- Crypto market cycles, regulatory clarity, and competition from other utility tokens

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Staking Rewards Fueling Long-Term Loyalty

Layered atop these innovations, Chiliz launched Fan Token Staking in February 2025 via the Socios. com Wallet. Lock your $JUV or $PSG, earn daily points redeemable for merch drops or match experiences. It’s a low-risk yield mechanism, encouraging holders to stick around rather than flip on whims. Over 200,000 users minted NFTs post-Naver Pay integration, underscoring scalability.

Clubs gearing up for the 2025 Club World Cup, including PSG, Barça, and Man City, amplify this with token-gated AR events. Fans vote on initiatives, their stakes compounding rewards. Check out how fan tokens are transforming matchday experiences for deeper dives. With CHZ holding at $0.0315, this ecosystem maturity hints at undervaluation for patient allocators.

Juventus pioneered this space, their Fan Token Offering via Socios. com setting the blueprint. Now, as U. S. frameworks evolve, expect tier-1 launches to accelerate. It’s not without risks; regulatory headwinds loom, demanding diversified stacks. Still, the matchday metamorphosis positions Fan Tokens as portfolio anchors in sports crypto.

Naver Pay’s integration exemplifies this momentum, onboarding over 200,000 unique users to mint NFTs on Chiliz Chain in mere weeks. Such partnerships underscore football fan tokens real world use, converting hype into habitual engagement. For investors, it’s a cue to allocate modestly; at $0.0315, CHZ offers entry into a sector blending passion with profit, tempered by volatility hedges like stablecoin pairings.

Unlocking PSG Fan Token Matchday Utility

Paris Saint-Germain exemplifies pinnacle integration, where PSG fan token matchday utility spans payments, AR, and staking. Holders access VIP zones via token burns, scan for immersive player holograms, or stake for priority lotteries on Champions League seats. Celebrating five years, $PSG became Chiliz’s first sports team validator, pioneering governance that fans directly shape. This maturity attracts institutional eyes, yet demands scrutiny of liquidity pools to avoid impermanent loss pitfalls.

Juventus mirrors this with Juventus fan token VIP access 2025 enhancements, from cashless scarves to AR jersey customizations. Socios. com’s app centralizes it all, free to join but potent with tokens. As Club World Cup looms, these clubs-PSG, Barça, Man City-gear for global spectacles, token holders poised for cross-continental perks.

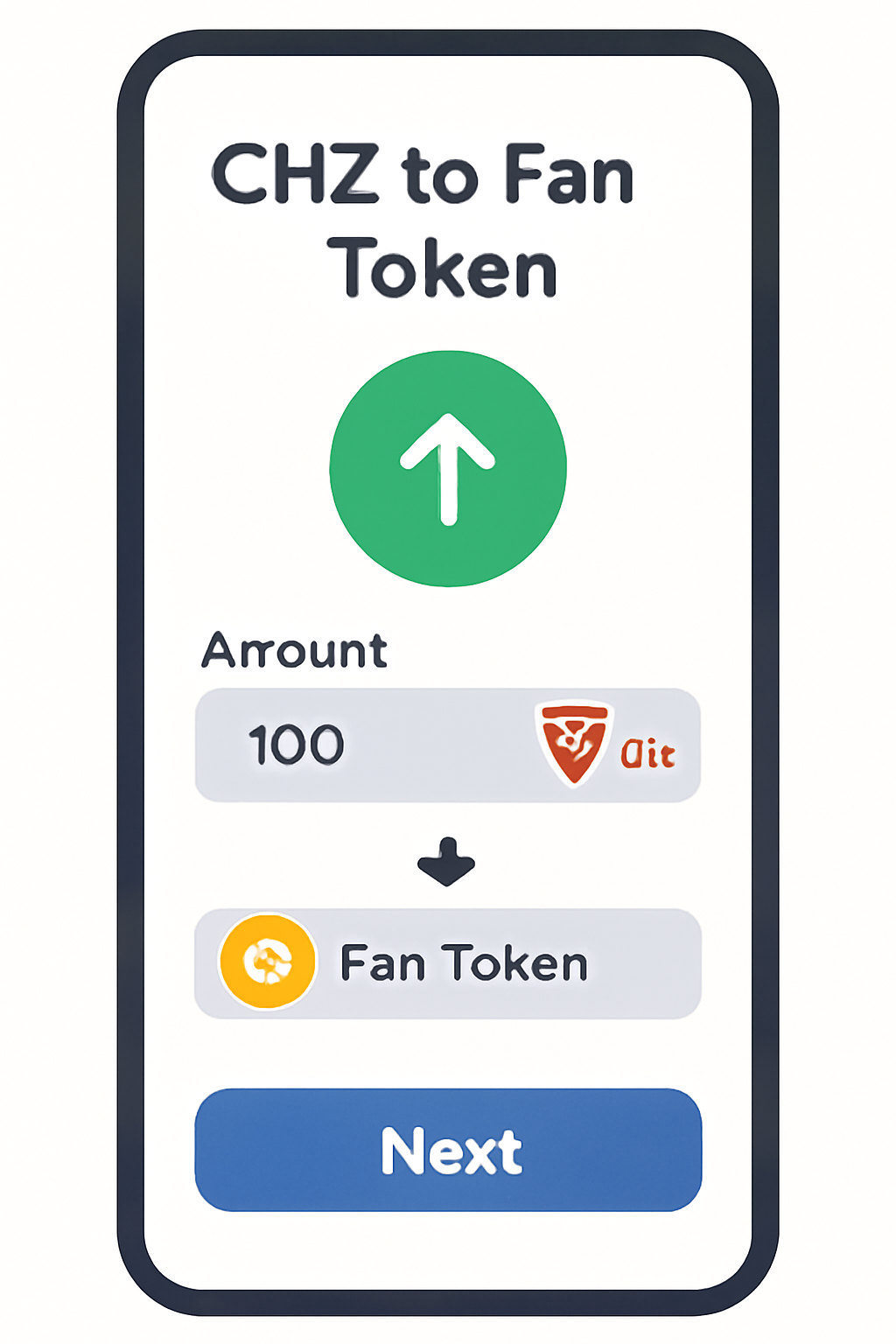

Step-by-Step: Engaging with Fan Tokens on Matchday

Following these steps demystifies entry, turning spectators into stakeholders. Start small-5% portfolio slice suffices-diversify across $JUV, $PSG, $ATM for balanced exposure. Monitor CHZ at $0.0315; its 24-hour high of $0.0319 signals resilience, low of $0.0305 tests support.

Risks persist: crypto winters hit sentiment tokens hardest, regulatory shifts in the U. S. could delay launches. Yet, Chiliz’s pivot to utility mitigates this, evidenced by Alchemy Pay’s seamless fiat ramps and Naver’s user surge. Teams fund youth academies and renovations directly, fostering sustainable growth over pump-and-dump cycles.

Looking ahead, 2025’s Club World Cup spotlights Fan Tokens’ apex. Barça fans vote on tactics via polls, Man City unlocks AR stadium tours, all gated by holdings. Socios. com’s hackathons birth apps like PSG Stadium, previewing Web3’s sports frontier. Binance notes tier-1 U. S. pushes as frameworks mature, potentially exploding volumes.

Strategically, stack staking yields atop AR velocity; redeem points for irreplaceable memories, not just merch. As a CFA candidate honing structured products, I advocate 12-24 month horizons: let adoption compound. CHZ’s ecosystem, with Fan Tokens at its core, isn’t chasing moons; it’s building dynasties, one tap at a time.

Front Office Sports dubs Socios a blockchain case study for monetizing fandom uniquely. Milk Road eyes U. S. potential, funding stadiums worldwide. Dive deeper via how to buy soccer fan tokens step-by-step, positioning your portfolio for the fan economy’s championship run.