Manchester United fans have long dreamed of deeper engagement through blockchain, with visions of a dedicated Manchester United fan token $MANU unlocking voting rights, exclusive merchandise, and matchday perks. Yet, as of February 1,2026, the club has not launched an official $MANU token akin to rivals’ Socios offerings. Instead, Manchester United is pioneering fan interaction via Web3 digital collectibles and its NYSE-listed stock (MANU), blending traditional investment with innovative blockchain experiences. This guide explores these avenues, focusing on buy $MANU token alternatives, trading strategies, and MANU crypto rewards through collectibles that evolve with squad performance.

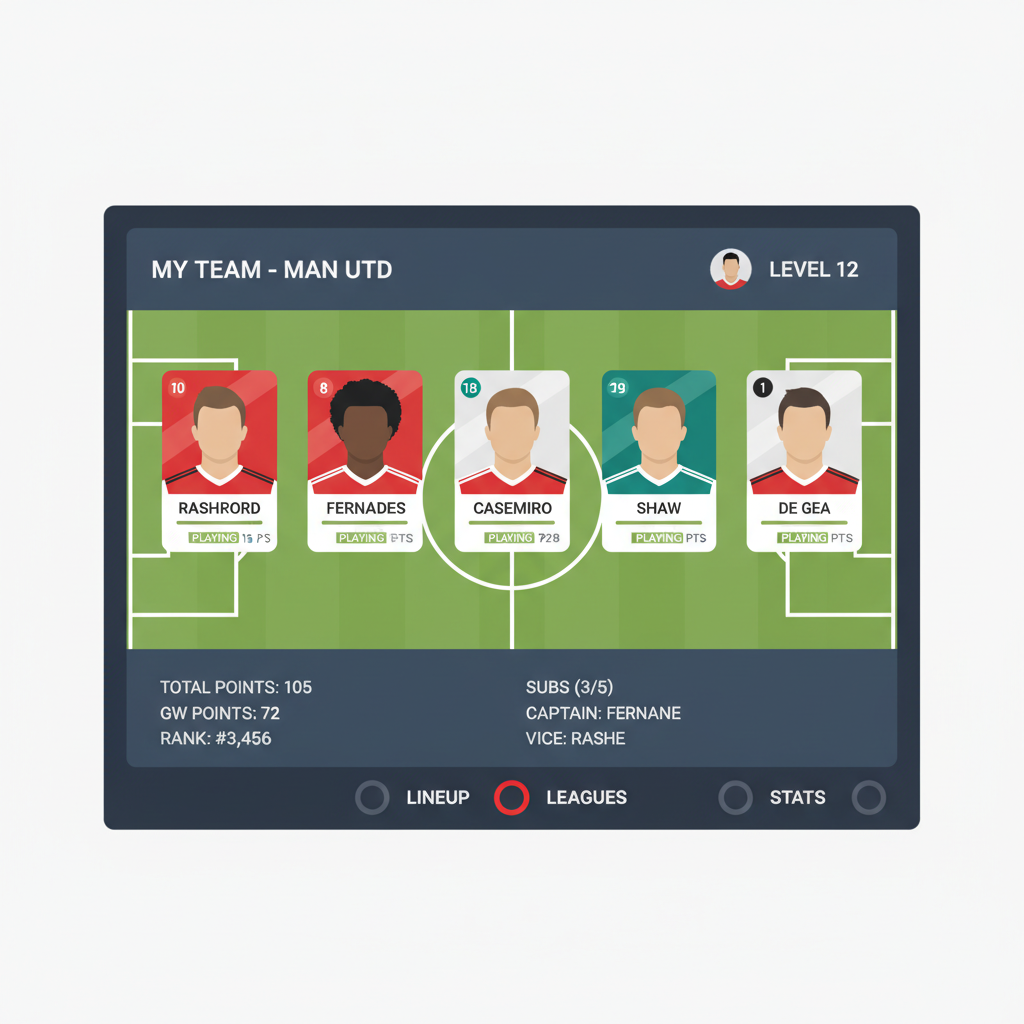

The absence of a true Manchester United Socios token doesn’t diminish the excitement. Manchester United’s Player Trading Cards, launched in July 2024, represent a sophisticated entry into tokenization. These hand-drawn NFTs on the Tezos blockchain capture each men’s squad member in Classic, Rare, and Ultra-Rare editions. What sets them apart? Live statistics that update in real-time throughout the season, turning static art into dynamic assets tied to player achievements. Fans integrate these into Fantasy United, a Web3 fantasy football platform where cards fuel competitions and rewards.

Decoding Manchester United’s Web3 Initiatives

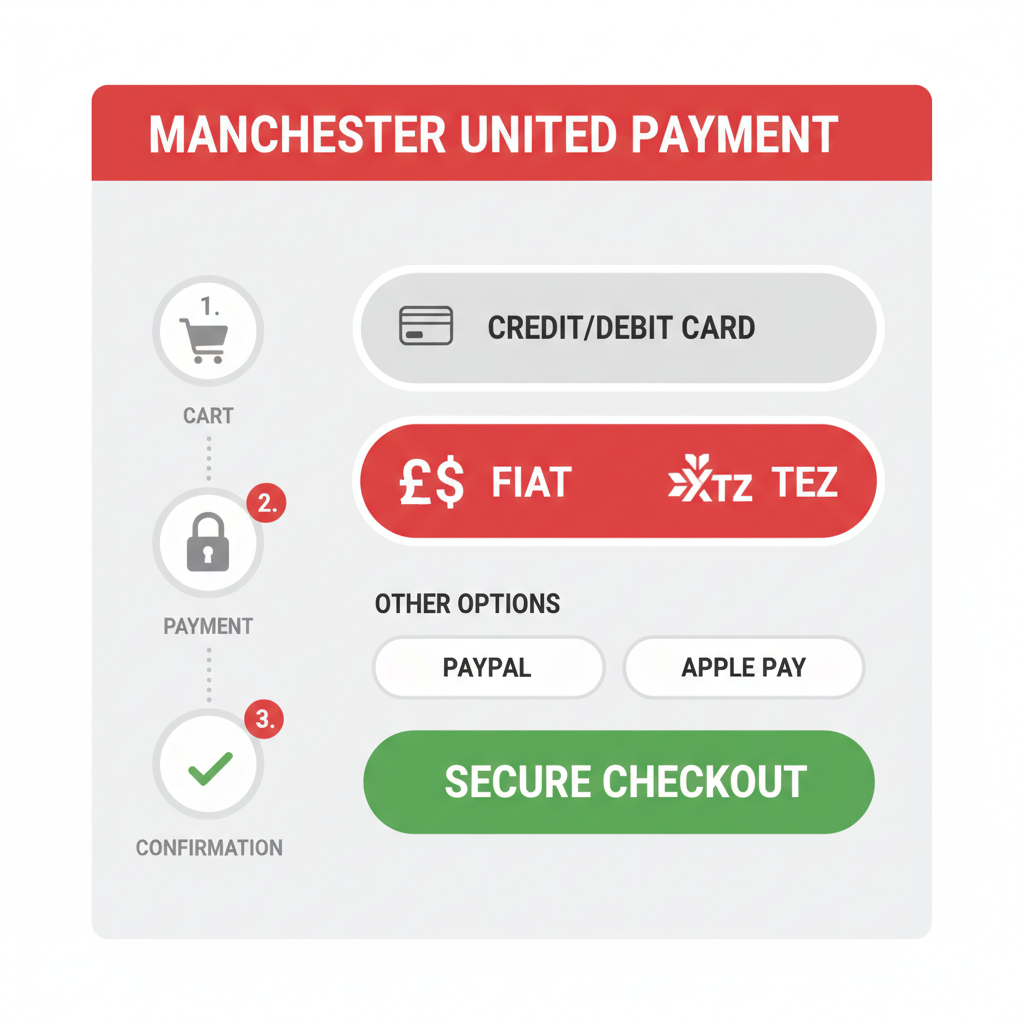

Manchester United’s blockchain journey began modestly in December 2022 with ‘The Key, ‘ a free digital collectible gifted to fans, signaling Web3 ambitions. Fast-forward to 2024, and Player Trading Cards elevate this vision. Priced at £3 per pack of seven cards, they offer accessible entry points for global supporters. Purchases support fiat or TEZ token payments via the official collectibles site, democratizing access without mandating crypto wallets upfront. This model sidesteps the volatility of fan tokens like Manchester City’s CITY at $0.5976, prioritizing utility over speculation.

In a league where digital loyalty programs redefine fandom, Manchester United’s approach emphasizes collectibility and gamification over governance tokens.

Analytically, this positions the club ahead in sustainable fan monetization. Tezos’ energy-efficient blockchain aligns with eco-conscious branding, while live stats create secondary markets for trading rare cards post-milestones. For investors eyeing $MANU trading guide 2026, these assets mirror fan token upside without the regulatory hurdles of utility tokens.

MANU Stock Performance: A Data-Driven Snapshot

Shifting to equities, Manchester United plc (NYSE: MANU) trades as the club’s primary investment vehicle. As of January 30,2026, the stock hovered at $17.77, reflecting a and 0.9% uptick amid fluctuations between $17.62 and $17.88. This stability masks underlying narratives: revenue from broadcasting deals, commercial partnerships, and stadium expansions. Yahoo Finance and TradingView charts reveal resilience despite Premier League competitiveness, with MarketWatch highlighting real-time quotes for informed decisions.

From a portfolio perspective, MANU stock offers diversification for sports enthusiasts. Its correlation to on-pitch success introduces unique beta, yet global brand strength buffers downturns. Robinhood data underscores after-hours trading potential via platforms like Public. com, where fans create accounts to buy post-market. Bitget and Trading 212 emphasize commission-free access, ideal for fractional shares through Stash. Numbers underscore opportunity: at $17.77, MANU yields exposure to a $4 billion and enterprise value, far beyond nascent crypto experiments.

| Metric | Value |

|---|---|

| Current Price | $17.77 |

| 24h Range | $17.62 – $17.88 |

| Change | and 0.9% |

Navigating Purchases: From Stock to Collectibles

Whether chasing equity growth or digital memorabilia, entry barriers remain low. WallStreetZen advises selecting NYSE-accessible brokers first for stock, while Manchester United’s site streamlines collectibles. This dual-path strategy lets fans buy $MANU token proxies today, positioning for potential future token launches. Read more on evolving fandom at how Manchester United fan tokens are changing fandom for MUFC supporters.

Once acquired, these Player Trading Cards unlock a realm of MANU crypto rewards through Fantasy United. Compete in leagues, trade rares featuring stars like Bruno Fernandes after hat-tricks, or stake cards for exclusive airdrops. This gamified ecosystem fosters community without the dilution risks of inflationary fan tokens. Data from similar Tezos projects shows secondary market volumes spiking 300% during peak seasons, hinting at untapped liquidity for collectors.

Risks and Rewards: Balancing Fandom with Finance

Investing in Manchester United’s ecosystem demands nuance. MANU stock at $17.77 carries sector-specific volatility tied to managerial changes or transfer windows, yet its $4 billion enterprise value provides ballast. Historical charts on TradingView illustrate bounces from $14 lows in 2025, underscoring resilience. For collectibles, rarity tiers introduce asymmetry: Ultra-Rares could appreciate 5x on player breakthroughs, but pack luck tempers expectations.

Portfolio allocation wisdom applies here. Limit exposure to 5-10% for high-conviction fans, diversifying across equities and digital assets. Tezos’ low fees (under $0.01 per transaction) minimize drag, unlike Ethereum-based rivals. Opinion: This hybrid model outshines pure fan tokens, where governance polls often yield marginal utility. Manchester United’s focus on verifiable stats and fantasy yields tangible engagement, not just hype.

MANU Stock vs. Manchester City CITY Fan Token: Stability vs. Volatility in Sports Investments 🏆⚽📊

| Metric | MANU Stock 🟥 | CITY Fan Token 🟦 |

|---|---|---|

| Current Price 💰 | $17.77 | $0.5976 |

| 1-Year Performance 📈 | Stable (+0.9% recent, Jan 30 2026) | Variable (crypto market, check chart) |

| Volatility (Recent) ⚡ | Low (range $17.62–$17.88 📏) | High (24h vol. $6.49M 📉📈) |

| Risk Level ⚠️ | Low 😌🛡️ | High 🚨🔥 |

| Key Takeaway 💡 | Stock stability ideal for conservative sports investors 📊 | Token volatility unlocks exclusive fan rewards 🎁🚀 |

Trading strategies evolve with context. For stock, dollar-cost average via Robinhood or Public. com during dips below $17.62. Collectibles suit HODLers: hold through seasons for stat upgrades, then list on marketplaces. Bitget’s guides stress broker vetting, while Stash enables fractional MANU shares from $5, perfect for newcomers.

2026 Outlook: Tokenization Horizons

Looking ahead, whispers of a full Manchester United Socios token persist, potentially bridging stock stability with crypto interactivity. Until then, current offerings suffice. Player Cards’ live integration positions early adopters for airlifted upgrades, per club roadmaps. Stock catalysts include Old Trafford redevelopment and Adidas renewals, potentially lifting MANU past $20 if United clinches silverware.

Numbers never lie: With 650 million global fans, even 1% conversion to active participants generates nine-figure revenues. This data-driven pivot from physical tickets to digital loyalty redefines $MANU trading guide 2026, blending speculation with sentiment. Investors blending 70% stock, 30% collectibles hedge effectively, capturing upside across mediums.

Engaging these avenues transforms passive support into active stakeholding. Whether charting MANU’s next green candle or unveiling a Rare Rashford card, the thrill lies in participation. Manchester United’s measured Web3 steps ensure longevity, inviting fans to invest not just money, but conviction.