As we navigate the evolving landscape of sports and blockchain in 2026, the Arsenal Fan Token ($AFC) stands as a compelling bridge between unwavering Gooner loyalty and strategic investment opportunities. Trading at $0.3625 today, with a modest 24-hour gain of and $0.003210 ( and 0.8950%), $AFC encapsulates the broader tokenization trend reshaping fan engagement. This isn’t merely a digital collectible; it’s a stake in Arsenal’s future, powered by Chiliz and the Socios platform, offering polls, exclusive rewards, and a voice in club decisions. In a Premier League saturated with tokenized assets, $AFC’s resilience post its all-time low of $0.2851 in October 2025 signals strategic depth for long-term holders.

The Big Picture: Why $AFC Matters for Gooners in 2026

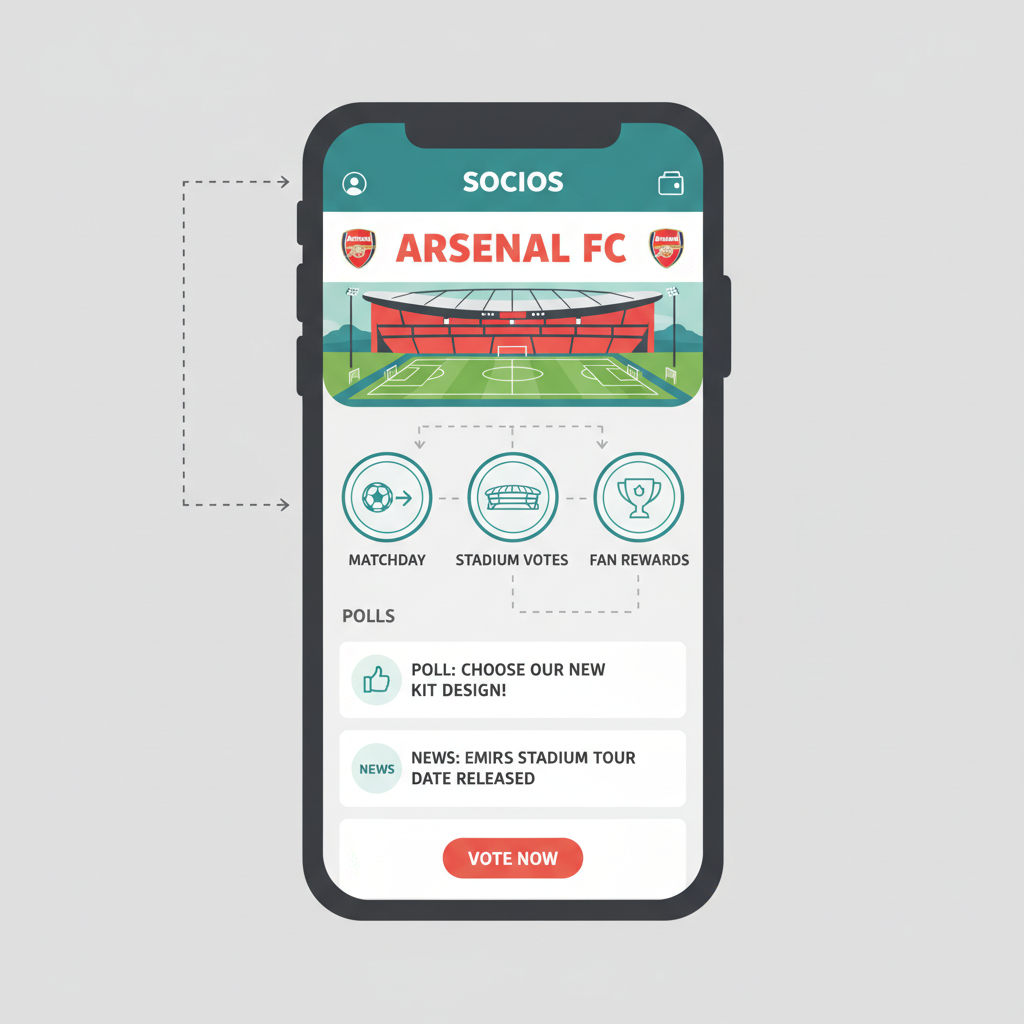

Tokenization of sports fandom has matured beyond hype, positioning Arsenal Fan Token as a macro play on community-driven value. At $0.3625, $AFC reflects not just market sentiment but Arsenal’s on-pitch momentum, like the 49% surge since October 2025 fueled by a 2-0 Brentford victory in December. Socios. com integrates $AFC seamlessly, letting holders vote on jersey designs, matchday experiences, and VIP access, turning passive support into active participation. This aligns with Chiliz’s roadmap for US expansion, national teams, and omnichain growth ahead of the 2026 FIFA World Cup, amplifying $AFC’s ecosystem potential. For Gooners, it’s strategic: gooners fan token rewards like signed merchandise or stadium tours create scarcity-driven utility, distinct from generic crypto volatility.

Reflecting on two decades in global markets, I’ve seen asset classes disrupted by overlooked trends. Fan tokens like arsenal socios token exemplify this, blending emotional capital with blockchain scarcity. Technicals scream ‘Strong Buy’ as of early February, yet the real edge lies in network effects; as Arsenal climbs Premier League tables, $AFC’s holder base expands, unlocking deeper club ties.

In the grand scheme, $AFC isn’t chasing pumps; it’s building a tokenized legacy for Arsenal’s global empire.

$AFC Market Dynamics: Trading at $0.3625 Amid 2026 Catalysts

Current metrics paint a steady picture: 24-hour high of $0.3634, low of $0.3590, against an all-time high of $8.13 from 2021. Forecasts diverge strategically; optimistic models eye $10.48 by year-end, while conservatives peg $0.4238, underscoring $AFC’s sensitivity to Arsenal’s performance and Chiliz ecosystem growth. Premier league fan tokens 2026 thrive on such dualities, where match results ripple into token value, as seen in the post-Brentford rally.

Arsenal Fan Token (AFC) Price Prediction 2027-2032

Realistic forecasts incorporating bullish (club success, Chiliz roadmap, crypto bull cycles) and bearish (market downturns, regulatory hurdles) scenarios from current $0.3625 baseline

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2027 | $0.32 | $1.05 | $3.20 |

| 2028 | $0.45 | $1.65 | $5.10 |

| 2029 | $0.65 | $2.40 | $7.50 |

| 2030 | $0.90 | $3.30 | $9.80 |

| 2031 | $1.20 | $4.50 | $12.50 |

| 2032 | $1.50 | $6.00 | $15.00 |

Price Prediction Summary

AFC shows strong long-term potential with average prices climbing to $6 by 2032, fueled by Arsenal’s fan engagement and Chiliz ecosystem expansions, though volatility persists; bullish max reflects ATH recovery amid World Cup hype and adoption.

Key Factors Affecting Arsenal Fan Token Price

- Arsenal FC on-field success and fan voting rewards driving demand

- Chiliz Fan Token roadmap with US expansion and 2026 FIFA World Cup catalysts

- Crypto market cycles: potential bull run in 2027-2028 boosting fan tokens

- Regulatory clarity for sports tokens and listings on Bitget/MEXC/Socios

- Technological upgrades in omnichain interoperability and DEX integrations

- Competition from other fan tokens and broader market cap constraints

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Strategically, this positions $AFC for omnichain interoperability, reducing friction in afc fan token chiliz trades. Exchanges like Bitget, MEXC, and KuCoin dominate volume, with DEX options for advanced users. The reflective investor asks: in a post-2026 World Cup world, does $AFC’s utility scale with Arsenal’s ambitions? Early signals say yes.

Mastering the Buy: How Gooners Acquire $AFC Tokens

Securing arsenal fan token starts with intent, not impulse. Primary path: Socios. com app. Create an account, top up wallet with Chiliz ($CHZ) via debit/credit, then swap for $AFC under Arsenal’s section. This fiat-to-token flow ensures beginners engage club rewards instantly.

- Via Centralized Exchanges (Recommended for Speed): Platforms like MEXC or Bitget. Sign up, deposit USDT/fiat, spot trade $AFC/USDT. KuCoin suits novices with intuitive interfaces.

- Socios Direct: App wallet; buy $CHZ in-app, exchange for $AFC. Ideal for reward-focused Gooners.

- DEX Route: Bridge via PancakeSwap or similar post-$CHZ acquisition, for those prioritizing decentralization.

At $0.3625, entry timing favors dips near $0.3590 support. Post-purchase, transfer to Socios for polls; this unlocks buy afc token true value. Strategically, stack during Arsenal win streaks, as sentiment drives 20% and spikes.

Once in hand, $AFC transforms from a traded asset into a gateway for tangible benefits, where gooners fan token rewards elevate fandom beyond the stands. Socios polls on kit designs or match captains aren’t novelties; they forge emotional equity, resilient against price dips to $0.3590. Arsenal’s integration deepens this, with holders accessing AR experiences or priority tickets, metrics that have driven holder retention amid volatility.

Claiming Rewards: Step-by-Step to Arsenal Exclusives

These mechanics underscore $AFC’s utility layer, absent in pure spec plays. Reflecting on tokenization’s arc, I’ve watched similar assets falter without real-world hooks; Arsenal’s execution, tied to Chiliz’s omnichain push, positions it for 2026 scalability. As premier league fan tokens 2026 compete, $AFC’s reward velocity could catalyze breakouts past $0.4238 forecasts.

Trading Arsenal Fan Token: Gooners’ Checklist for $0.3625 Entry

Trading $AFC demands discipline, blending technicals with club catalysts. At $0.3625, with ‘Strong Buy’ signals, layer entries on pullbacks reward patience; I’ve managed portfolios where sentiment-aligned timing outperformed blind HODL. DEX paths via $CHZ add leverage for yield farmers, yet centralized spots like KuCoin streamline for most. Watch Brentford-like wins; they imprint 20% moves, compressing conservative $0.4238 targets.

Strategic depth emerges in portfolio allocation: cap afc fan token chiliz at 5-10% for diversification, rebalancing post-poll hype. Chiliz’s US and World Cup roadmap injects macro tailwinds, potentially vaulting $AFC toward $10.48 if Arsenal contends. Yet, this isn’t speculation; it’s calculated exposure to fandom’s tokenized evolution.

Navigating Risks: Reflections on $AFC’s 2026 Path

Volatility shadows every token, $AFC no exception; from $8.13 peaks to $0.2851 troughs, it mirrors Premier League drama. Regulatory shifts or Chiliz stumbles could pressure $0.3625 floors, demanding vigilant holders. My two decades affirm: true alpha accrues to those dissecting ecosystem moats over charts alone. Arsenal’s global draw, fused with Socios, fortifies against downturns, especially as national team tokens proliferate.

Forward-looking Gooners eye interoperability gains, where $AFC flows seamlessly across chains, amplifying arsenal socios token trades. Pair this with on-pitch resurgence, and $0.3625 becomes a springboard. In tokenizing loyalty, Arsenal leads; holders who grasp this macro shift stand to redefine investment in scarlet passion.

Tokenized fandom endures because it captures the unquantifiable: a Gooner’s roar, immortalized on-chain.