Paris Saint-Germain’s $PSG Fan Token is not just a crypto asset – it’s a case study in how blockchain can fundamentally reshape the relationship between football clubs and their global fanbases. While many sports tokens promise utility, PSG’s approach stands out for its scale, innovation, and direct connection to tangible club experiences. As of September 28,2025, the $PSG Fan Token trades at $1.53, reflecting both its strong community backing and dynamic market forces.

From Spectator to Stakeholder: The Utility of PSG Fan Tokens

Traditional fandom often means cheering from the sidelines – but with the advent of football club crypto tokens like $PSG, fans are now empowered participants. Launched in 2018 via a partnership with Socios. com and operating on the Chiliz blockchain, the PSG Fan Token gives supporters real voting rights on club decisions. These range from selecting inspirational messages for the captain’s armband to influencing kit designs and even choosing celebratory music at Parc des Princes.

This isn’t theoretical utility; it’s real-world influence. According to CoinMarketCap, token holders have already shaped multiple club moments by participating in official polls. The more tokens you hold, the greater your voting power – a clear example of how fan token voting rights are changing sports governance.

Exclusive Rewards and VIP Access: Beyond Digital Ownership

The practical rewards for holding $PSG go far beyond digital bragging rights. Fans have won opportunities to travel with the first team, attend VIP matchday experiences, meet players, and get their hands on exclusive match-used merchandise. These aren’t generic perks; they’re once-in-a-lifetime moments that deepen emotional investment in the club.

This unique blend of access and engagement has fueled demand for $PSG tokens worldwide. For those searching where to buy PSG fan token, platforms like Socios. com and major exchanges offer easy entry points – but it’s what you do after buying that matters most. The token is your gateway to a multi-layered ecosystem of rewards, blending digital engagement with real-world benefits as detailed on FanTokens.com.

Five Exclusive Perks for PSG Fan Token Holders

-

VIP Matchday Experiences: PSG Fan Token holders can access exclusive VIP packages, including premium seating, hospitality suites, and behind-the-scenes stadium tours on matchdays, creating unforgettable moments at Parc des Princes.

-

Official Club Decision Voting: Holders of $PSG tokens have the unique right to vote on select club matters, such as choosing inspirational messages for the captain’s armband and influencing kit designs, giving fans a direct voice in club affairs.

-

Meet-and-Greets With Players: Token holders are regularly entered into draws for exclusive meet-and-greet sessions with first-team players, offering rare opportunities for personal interaction and autographs.

-

Access to Limited Edition Merchandise: Exclusive merchandise, including match-used memorabilia and limited-run PSG collectibles, is made available only to Fan Token holders, enhancing the value of club loyalty.

-

Participation in Unique Club Events: From attending private training sessions to joining global fan celebrations, $PSG Fan Token holders are invited to special events that are inaccessible to the general public, deepening their connection with the club.

Chiliz Chain Validator: Paris Saint-Germain’s Blockchain Innovation

A milestone arrived in 2024 when Paris Saint-Germain became the first major football club to serve as a validator on the Chiliz Chain. This technical leap isn’t just about prestige; it has profound market implications for Paris-Saint Germain crypto. As a validator, PSG verifies transactions and authorizes smart contracts across the network. Most critically for investors, PSG has pledged to use 100% of its validator revenue for decentralized buybacks of $PSG tokens – creating a self-sustaining digital economy that aligns club incentives with those of token holders.

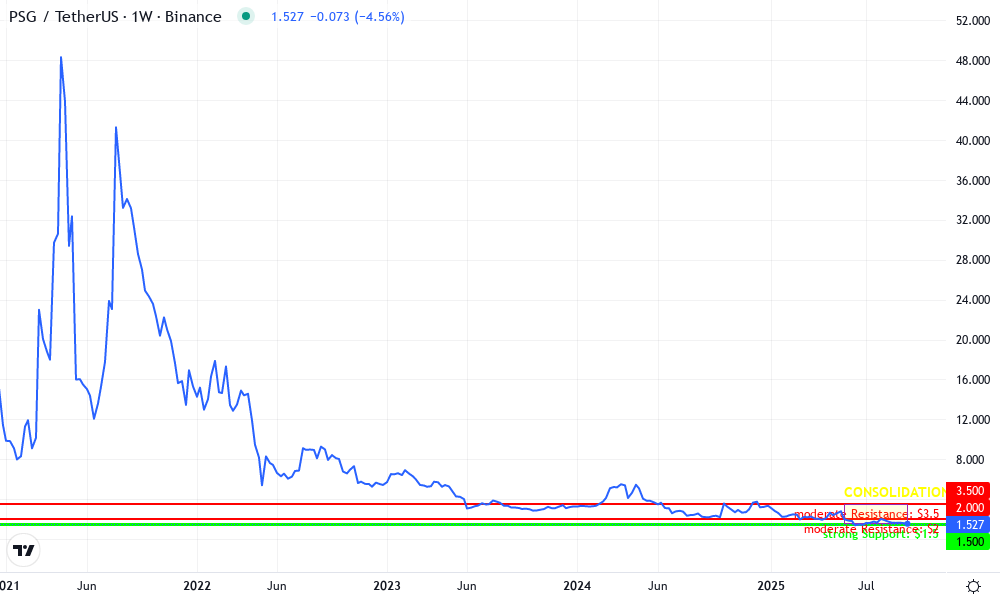

Paris Saint-Germain Fan Token Technical Analysis Chart

Analysis by Graham Bennett | Symbol: BINANCE:PSGUSDT | Interval: 1W | Drawings: 4

Technical Analysis Summary

From a conservative, fundamentally driven perspective, the PSGUSDT weekly chart illustrates a pronounced downtrend since the speculative peaks of 2021, with price persistently declining and entering a prolonged phase of low volatility and sideways movement below $4.00 throughout 2024 and into 2025. The structural support is now centered around $1.50, aligning with live market data. There is little technical evidence for a reversal; instead, the chart suggests continued stabilization near current levels unless catalyzed by fundamental improvements—such as increased token utility adoption, buyback effects from validator revenue, or a major on-field performance event. For drawing: mark a horizontal support line at $1.50, resistance at $2.00 and $3.50, and use a rectangle to highlight the extended consolidation zone from mid-2024 through September 2025.

Risk Assessment: medium

Analysis: While price has stabilized after a multiyear decline, true upside depends on fundamental improvements, not just technical stabilization. Downside risk persists if club engagement or buybacks falter.

Graham Bennett’s Recommendation: For conservative investors, wait for evidence of fundamental growth or accumulation before sizing up any new position. Use tight stops and avoid leverage.

Key Support & Resistance Levels

📈 Support Levels:

-

$1.5 – Current price floor, tested multiple times in 2025, matches live price context.

strong

📉 Resistance Levels:

-

$2 – Near-term resistance, previous minor bounce zone in 2024-2025.

moderate -

$3.5 – Mid-term resistance where prior rallies failed in late 2024.

moderate

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$1.53 – Potential low-risk entry for long-term holders if fundamentals improve, but confirmation needed.

medium risk

🚪 Exit Zones:

-

$2 – First profit target at minor resistance.

💰 profit target -

$1.4 – Stop-loss just below established support for conservative risk management.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume not visible in this chart image; recommend monitoring for accumulation spikes near support.

Watch for significant volume increases as a sign of renewed interest or accumulation at the $1.50 level.

📈 MACD Analysis:

Signal: No MACD visible; but expect persistent bearish crossovers in this environment. Bullish signal only if MACD crosses up with price above $2.00.

MACD likely remains bearish until a clear breakout above $2.00 is seen.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Graham Bennett is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

This innovative structure supports price stability while reinforcing community trust in long-term value creation.

$PSG Price Dynamics: Riding Club Successes and Market Sentiment

The interplay between football performance and crypto markets is especially vivid with PSG’s fan token. For example, following PSG’s emphatic 4-1 victory over Barcelona in the UEFA Champions League quarterfinals, $PSG surged by 13%. This correlation demonstrates how sporting milestones can trigger immediate financial responses within digital asset markets (Dapp.Expert).

Paris Saint-Germain (PSG) Fan Token Price Prediction 2026-2031

Forecast based on club performance, crypto adoption, and evolving fan engagement utility.

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.30 | $1.75 | $2.20 | +14% | Potential volatility driven by Champions League outcomes and ongoing validator buybacks. |

| 2027 | $1.25 | $1.95 | $2.60 | +11% | Broader sports token adoption and new PSG fan initiatives could boost demand. |

| 2028 | $1.20 | $2.15 | $3.10 | +10% | Tech upgrades on Chiliz Chain and global football events may increase utility. |

| 2029 | $1.10 | $2.40 | $3.70 | +12% | Regulatory clarity on fan tokens and more club partnerships could fuel growth. |

| 2030 | $1.05 | $2.70 | $4.30 | +13% | Mainstream crypto adoption and international fan engagement drive higher ceilings. |

| 2031 | $1.00 | $3.00 | $5.00 | +11% | Wider integration with club ecosystem and NFT/fan experiences expand use cases. |

Price Prediction Summary

The PSG Fan Token ($PSG) is projected to experience steady growth through 2031, with average prices rising from $1.75 in 2026 to $3.00 in 2031. The token’s minimum price is expected to remain relatively resilient due to ongoing buybacks and strong fan utility, while maximum prices could see significant spikes during major club victories or global football events. The outlook is positive but reflects both the opportunities and volatility inherent to sports-based crypto assets.

Key Factors Affecting Paris Saint-Germain Fan Token Price

- PSG’s on-field performance, especially in major tournaments like the Champions League.

- Continued commitment to buybacks as a Chiliz Chain validator.

- Expansion of fan token utilities (voting, VIP experiences, merchandise, etc.).

- Overall adoption of fan tokens in the football and sports industry.

- Regulatory developments regarding fan engagement tokens.

- Competition from other club tokens and sports crypto projects.

- General crypto market sentiment and cycles.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The current price of $1.53 encapsulates not just recent results but also ongoing innovations around fan engagement and blockchain integration.

As the landscape of sports fan token guides continues to evolve, the $PSG Fan Token stands as a benchmark for both utility and emotional value. The ability to influence club decisions, paired with tangible rewards and a transparent blockchain backbone, sets PSG apart from clubs experimenting with more basic digital collectibles. The result is a vibrant, two-way relationship where the club and its supporters share in both cultural moments and financial upside.

Looking ahead, the potential for further integration between the physical and digital realms is immense. As more clubs adopt validator roles or experiment with decentralized governance models, expect to see an even broader spectrum of $PSG token rewards: from augmented reality experiences on matchdays to direct participation in club strategy forums. The Paris Saint-Germain model is already influencing how other elite teams approach tokenization, pushing the envelope on what it means to be not just a fan but a stakeholder.

Navigating Risks and Opportunities: A Data-Driven Perspective

Of course, no crypto asset is without volatility. While $PSG’s price currently sits at $1.53, market sentiment can shift quickly based on both on-pitch performance and broader trends in digital assets. The club’s commitment to regular buybacks as a Chiliz Chain validator offers some insulation against wild swings but does not eliminate risk entirely. Savvy fans and investors should track not only football results but also key blockchain developments that may impact token supply or utility.

The next phase of growth for Paris Saint-Germain’s fan token will likely hinge on expanding its real-world applications, think ticketing, loyalty programs, or even fractional ownership of memorabilia. As regulatory clarity improves across Europe and Asia, institutional interest could bring new liquidity to this niche market.

How to Get Involved: Practical Steps for Fans and Investors

If you’re ready to move from sideline supporter to active participant, acquiring $PSG tokens is straightforward via platforms like Socios. com or leading exchanges. But maximizing value requires more than just holding; engage with polls, contests, and community events that unlock deeper layers of access. For those new to crypto or sports tokens, start small, learn how voting works, explore exclusive content drops, and connect with other fans in online forums.

How to Buy Your First PSG Fan Token: Step-by-Step

-

1. Set Up a Cryptocurrency WalletTo securely store your $PSG Fan Tokens, create a wallet compatible with the Chiliz Chain—such as MetaMask (with custom network settings) or the Socios.com Wallet. Ensure you back up your wallet’s recovery phrase for security.

-

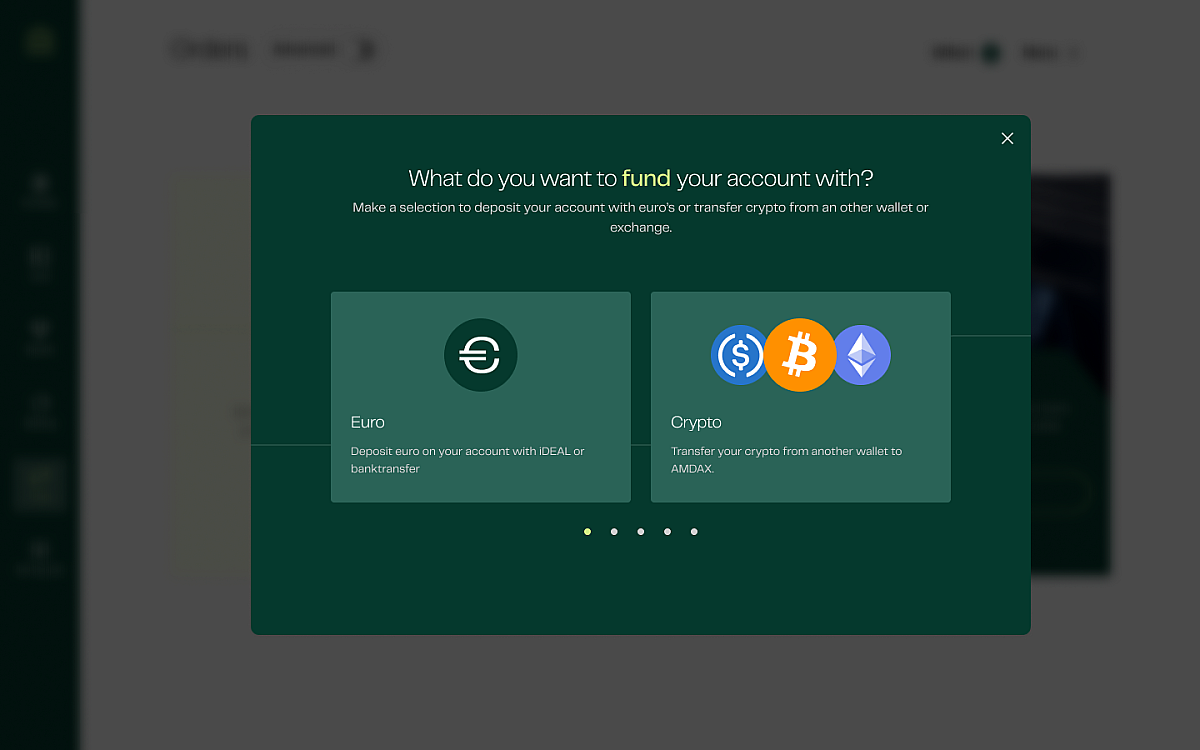

3. Deposit FundsTransfer fiat currency (like EUR or USD) or cryptocurrency (such as USDT or BTC) into your exchange account. Most platforms support bank transfers, credit cards, or crypto deposits.

-

4. Buy PSG Fan TokensNavigate to the PSG/USDT or PSG/BTC trading pair and place a buy order. As of September 28, 2025, the $PSG Fan Token is trading at $1.53. Review the price and confirm your purchase.

-

5. Transfer Tokens to Your WalletFor enhanced security, withdraw your $PSG Fan Tokens from the exchange to your personal wallet. Copy your wallet address carefully and confirm the transaction on the Chiliz Chain.

-

6. Connect to Socios.com for Fan ExperiencesLink your wallet or use the Socios.com app to access fan voting, VIP experiences, and exclusive rewards. This unlocks the full utility of your $PSG Fan Tokens within the Paris Saint-Germain ecosystem.

The future of football fandom is being written now, and Paris Saint-Germain remains at the forefront of this transformation. Whether you’re seeking VIP access at Parc des Princes or simply want your voice heard in shaping your club’s destiny, the $PSG Fan Token offers an unprecedented bridge between passion and participation.